Unlocking Financial Opportunities Through Hard Cash Loans genuine Estate Financial Investment

In the realm of genuine estate investment, the application of hard money loans has actually emerged as a critical device for smart financiers aiming to exploit on opportunities that standard funding may not conveniently use. The availability and speed at which tough cash financings can be protected existing a compelling proposal for those seeking to unlock the potential of their property ventures. By delving into the complexities of tough money providing and comprehending exactly how it can open up doors to lucrative investment potential customers, investors can browse the affordable landscape of realty with a distinctive benefit.

Comprehending Difficult Money Car Loans

While standard funding choices might be limited for genuine estate financiers, hard cash loans supply a viable alternative with distinct advantages and factors to consider. Hard money car loans are asset-based car loans safeguarded by the residential property itself, making them appealing to financiers who might not fulfill the strict requirements of typical lenders. These financings are typically issued by exclusive capitalists or business with a concentrate on property financial investments.

One secret benefit of difficult cash lendings is their quick approval process, permitting capitalists to protect financing in an issue of days contrasted to the lengthy approval timelines of typical loans. Furthermore, hard money lending institutions are primarily interested in the residential or commercial property's worth and possibility commercial instead of the borrower's credit rating, making them easily accessible to individuals with less-than-perfect credit history ratings.

Nevertheless, it is important for capitalists to very carefully think about the greater rate of interest prices and costs linked with tough money lendings. These prices can considerably impact the overall productivity of a realty investment project. Understanding the terms and payment expectations of difficult money car loans is crucial to making notified choices and making the most of the advantages they use.

Qualifying for Hard Cash Loans

Advantages of Difficult Money Finances

Checking out the benefits of difficult cash finances discloses the distinct economic chances offered to genuine estate financiers. Conventional financial institution financings can take weeks or also months to secure, whereas tough money financings can typically be gotten within days, enabling investors to act swiftly on profitable actual estate offers.

An additional advantage of hard cash lendings is their flexibility in terms of home kinds. Whether a capitalist is looking to acquire a property, commercial structure, or land for advancement, hard cash lenders are usually eager to fund a vast array of genuine estate projects. Additionally, difficult cash loans can be structured in a means that matches the specific needs of the investor, offering more individualized terms contrasted to typical car loans. On the whole, the advantages of difficult money lendings make them a useful device genuine estate financiers looking for chances for growth and earnings.

Realty Investment Approaches

Thinking about the monetary chances offered by hard cash car loans for real estate investment, a tactical strategy to residential or commercial property acquisition ends up being extremely important in making the most of potential returns. One crucial technique is to concentrate on buildings with high potential for gratitude. Buying locations undergoing gentrification or where infrastructure advancements are planned can result in considerable worth development in time. Executing a buy-and-hold technique can be useful, allowing financiers to profit from both rental earnings and building appreciation. Diversifying the realty financial investment profile across different home types and places can also see here reduce dangers and enhance total returns.

Maximizing Returns With Hard Money

Additionally, actively keeping an eye on market patterns and remaining informed concerning local genuine estate problems can help financiers make timely decisions to purchase, sell, or re-finance buildings for maximum returns. By carrying out these techniques, capitalists can open the full economic possibility of hard money fundings in actual estate investment.

Final Thought

To conclude, hard cash financings use actual estate capitalists a useful economic device to unlock opportunities and make best use of returns. hard money loans in my blog ga. By recognizing the certifications and benefits of tough money fundings, investors can tactically implement different property financial investment strategies. With the versatility and quick access to funds that tough cash fundings provide, capitalists can benefit from successful opportunities and accomplish their monetary objectives in the realty market

Edward Furlong Then & Now!

Edward Furlong Then & Now! Mara Wilson Then & Now!

Mara Wilson Then & Now! Michelle Pfeiffer Then & Now!

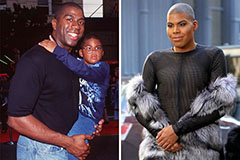

Michelle Pfeiffer Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!